Like many of their friends, clients, and colleagues in their baby boomer years, Cathy and her husband Rogge Dunn have experienced the challenges that come with aging parents. Cathy’s father Sam was a retired Marine whose health deteriorated as Alzheimers and dementia set in. We set up this diary to chronicle Cathy’s journey with Sam. As you’ll see, Sam’s adventures offer a bittersweet mix of humor and heartache. We hope Sam’s Story is a reminder to live in the moment, savoring the good times we have with family and friends while taking every opportunity to build memories that will last a lifetime.

Learning to navigate the medical and social services Sam needed – and all of the many bills that come with them – was an eye-opening experience for Cathy, and we’ve learned it’s an experience many of you have shared in caring for an aging parent. The good news is, you can plan today for how you will meet those expenses in the future. One of the best things you can do for your spouse, your children, and for yourself is to at least have the LTC (Long Term Care) conversation. There are levels of coverage for all budgets, and we are here to help answer any questions you might have.

Thanks again to all for your kind words and support!

Timeline

Keep Fighting Sam

Last Sunday while at church, Sam became unresponsive for 3 minutes. He was transported to Presbyterian Hospital where extensive testing determined that his carotid artery is 90% blocked. Unfortunately, doctors will not be able to perform surgery until his health stabilizes. Cathy has been with him all week monitoring his care.

On Friday 5/5/17, Sam was discharged to a rehabilitation facility. There, he will be monitored 24/7 as he is very high risk for another stroke. His next appointment with his cardiologist is 5/16/17. They hope to see some improvement by this time.

The game plan is to get him healthy enough to move forward with surgery by the end of the month. We should have more updates next week.

Thank you for your continued prayers.

Selfie Time!

Even waiting can be fun if you are with the right person.

Cheers!

Nothing like a shake and a sunny day with Sam!

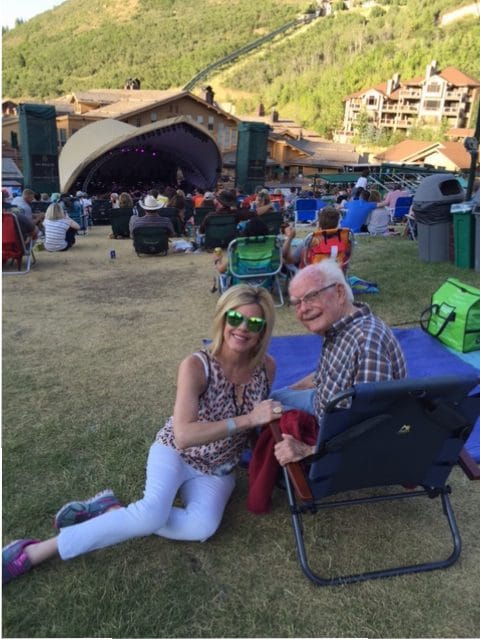

Enjoying Good Weather and a Show

It’s a great day for an outdoor show!

Admiring The Art

We couldn’t resist stopping for a photo op.

Sam Goes Off-Road

Time for some extreme fun!

Lunch Break

Today Sam got a much needed break from hospital food.

Enjoying a Good Burger

A good burger, shake and excellent company makes for a great day!